Chinese companies seem more inclined than their Western counterparts to migrate across sectoral boundaries and create larger platforms. This is perhaps because new opportunities have been popping up more frequently in China and its consumers are extremely savvy with smartphone apps. When they sense new demand patterns emerging, many Chinese companies quickly jump in to capture the opportunities even if they don’t have all the capabilities needed for competing in the new space. They try to make up for the gaps in capabilities both by themselves and often through platforms built upon collaborative partnerships.

In contrast, most Western corporations tend to focus on what they have been doing all along and avoid “diversification”. This is a result of the “core competence” doctrine that has governed the corporate strategy thinking in the West for about three decades. While many Chinese entrepreneurial companies, especially those in the tech sector, are more inclined to expand “horizontally” into new sectors, Western companies tend to stick to their business “vertically”. Foreign companies operating in China have now increasingly recognized this difference in approach and some of them are in the process of catching up, and along the way, learn how Chinese companies build their businesses and organizations. Some of them are even trying to participate in Chinese companies’ (and government’s) platforms.

New Game Changers

Some people have asserted that because BAT (Baidu, Alibaba and Tencent) have become so huge in size, they would stifle all other innovations in China. However, companies like ByteDance (and others such as Pinduoduo, Ping An and Xiaomi) have proved that non-BAT companies can also create their own innovation paths.

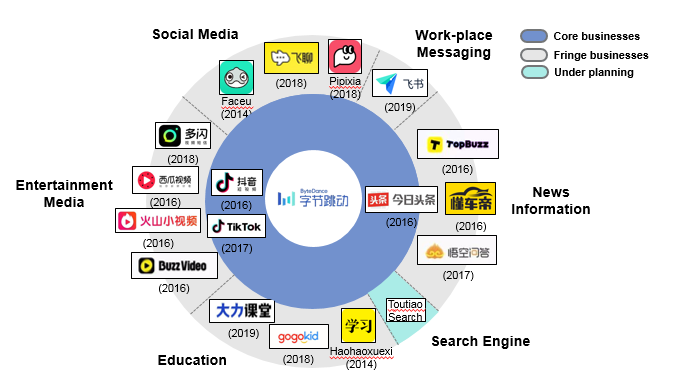

Established in 2012, ByteDance has been able to quickly amass a large number of users with its range of media applications that use AI to provide users with targeted content and information (I call this, “Segment of One”). One of their first products was Toutiao, a highly popular news aggregation service app in China, with an international version called TopBuzz. In 2017, Toutiao overtook Tencent News to become China’s most popular news app.

Since 2016, ByteDance launched a variety of video sharing apps that have become highly popular, the most successful being Douyin (known as Tiktok outside of China), a personalized video platform where users can upload and view 15-second videos, edited with special effects and music. The other video apps include Xigua, which shares videos around two to five minutes long, and Huoshan (Vigo Video outside of China), a video sharing platform that allows users to monetize their content. As a whole, ByteDance apps are now being used by more than a billion monthly active users and 600 million daily active users worldwide.

Having achieved such a level of ubiquitous usership, ByteDance has further leveraged this to migrate into areas that have already been dominated by players such as Tencent. With the release of Feiliao, a messaging app, and the acquisition of gaming startup Mokun Technology, ByteDance has now encroached upon two territories that have long been dominated by Tencent. While its technical capabilities may not be as developed as Tencent’s in messaging and gaming apps, ByteDance’s huge and highly engaged usership gives the company a legitimate chance to challenge the very core of Ten-cent. ByteDance has increased its share of “users’ share of time spent on internet applications” in China from under 4% in 2017 to over 11% in 2019, while Tencent’s share has dropped over 10 percentage points in the same period, from 54.3% to 43.8%, according to Questmobile, a data service provider focusing on mobile internet.

ByteDance has also entered the education sector with the launch of three education apps in 2018 and the hardware business with plans to develop its own smartphones. It is also looking to increase its competitiveness in international markets, especially on the back of the huge success of Tiktok. This includes entering the office productivity space, where companies like Slack have dominated, with the launch of ByteDance’s Lark app. ByteDance is also looking to enter the music business after acquiring Jukedeck, an AI music start-up based in the UK, as well as China’s search business, which has long been dominated by Baidu.

Exhibit 3