Bloomberg News, March 9, 2017

China’s biggest SUV maker is reconsidering its plan to build an auto plant in Mexico that would have made its best-selling vehicles for the U.S. market, joining a growing list of global automakers reviewing investment plans after tax threats by President Donald Trump.

Great Wall Motor Co., ltd by billionaire Chairman Wei Jianjun, may choose the U.S. instead for its first North American plant, General Manager Wang Fengying said in an interview. The company has a research center in Los Angeles and will accelerate preparations to develop U.S.-certified versions of its Haval SUVs for sale by 2020, Wang said.

“Your decisions should always adapt to the dynamic changes,” said Wang, a delegate at this week’s National People’s Congress in Beijing. There used to be many carmakers building plants in Mexico but Trump’s changes have affected their decision making, Wang said.

Trump has promised to renegotiate the North American Free Trade Agreement and criticized auto companies including General Motors Co. and Toyota Motor Corp. for shifting production south of the border. Under threats of punitive import duties, Ford Motor Co. and Japanese auto-parts maker Nisshinbo Holdings Inc. said they’ll scrap or reconsider new plants in Mexico.

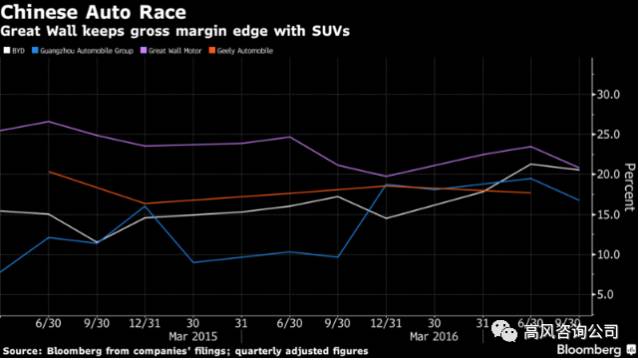

Great Wall, based in Baoding, Hebei province, is one of several Chinese automakers hoping to break into the U.S. with their own brands. Guangzhou Automobile Group Co. plans to start exporting its Trumpchi models to the U.S. from next year, while Warren Buffett-backed BYD Co. and Volvo Cars owner Zhejiang Geely Holding Group Co. have also declared American ambitions.

Lowering Risks

“Building in the U.S. is a hedge against a potential future trade barrier with Mexico,” said Bill Russo, managing director of Gao Feng Advisory Co. and a former head of Fiat Chrysler Automobiles NV’s Chrysler unit in China. “It would add cost to producing the vehicles but it reduces the potential tax risk.”

For more than 20 years, China has asked foreign carmakers wanting to set up manufacturing plants in its country to do so through joint ventures with domestic auto companies, a move that allowed many Chinese manufacturers to gain technology and eventually set up their own brands. Local marques like Geely, Trumpchi and Haval now account for almost half the Chinese market.

The Chinese carmakers are trying to reverse the tide and sell their own models to Europe and the U.S., just as the Republican-led House of Representatives is considering implementing a border-adjustment tax on companies’ imports but not their exports.

The proposals by Trump and lawmakers would raise the average cost of a car in the U.S. by about $3,300 and could even cost American jobs because carmakers source parts from around the world, Munich-based consultant Roland Berger GmbH. said in a presentation on March 8. The price increases would lead to about $34.6 billion in higher costs to consumers, assuming U.S. sales at the 17.5 million level recorded in 2016, the Center for Automotive Research said in a report Thursday.

Local Sales

In China, Great Wall is enjoying a sales surge as Chinese drivers embrace SUVs, despite government efforts to curb fuel consumption and emissions. The company’s domestic sales rose 26 percent last year to 1.1 million units, putting it ahead of Japan’s Mitsubishi Motors Corp. in global vehicle production. Abroad, though, it’s had less success, selling only 17,379 units last year, mainly in countries such as Russia, South Africa, Bulgaria and Australia.

The company is exploring opportunities in developed markets and wants to make the Haval brand global by 2020, said Wang. The company markets its SUVs in China as offering good value for money and prints ads with the title “See. Drive. Believe.” While overseas it also uses pictures of its vehicles driving in the off-road Dakar rally competition.

More than four out of every five vehicles Great Wall sells is an SUV and the company is under pressure at home as China tries to clean up the choking air in its biggest cities. The government has proposed rules that would require automakers to improve fuel economy and produce a higher proportion of so-called new-energy vehicles such as battery-powered cars. Wang said Great Wall plans to invest at least 60 billion yuan ($8.7 billion) in developing new-energy vehicles by 2025, without giving details on how the investment would be funded.